income tax rate 2019 malaysia

Foreigners with a non-resident status are subjected to a flat taxation rate of 28 this means that the tax percentage will remain the. 030 Malaysian ringgits MYR per litre is applicable to petroleum products.

Guam Corporate Tax Rate 2022 Data 2023 Forecast 2015 2021 Historical Chart

Calculations RM Rate TaxRM A.

. On the First 5000. 20182019 Malaysian Tax Booklet 7 Scope of taxation Income tax in Malaysia is. Additional rates will be implemented in case of special instances of income.

On the First 5000 Next 15000. Malaysia Income Tax Deduction YA 2019 Donations A tax deduction reduces the amount of your aggregate income which the sum of your total income for the year put together. This translates to roughly RM2833 per month after EPF deductions or about RM3000 net.

For the most part foreigners working in Malaysia. Rates Real Property Gains Tax Stamp Duty Sales Tax Service Tax Other. Based on this amount the income tax to pay the government is RM1640 at a rate of 8.

13 rows Malaysian ringgit A non-resident individual is taxed at a flat rate of 30 on total taxable income. As a general rule anyone earning a salary in Malaysia is required to pay income tax unless they fall into one of the exceptions. Effective from YA 2023 Accelerated capital allowance ACA for Industry 40.

Average Lending Rate Bank Negara Malaysia Schedule Section 140B Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. However if you claimed RM13500 in tax deductions and tax reliefs your chargeable income. Tax rate for MSME Income tax rate for the first RM100000 of chargeable income be reduced from 17 to 15.

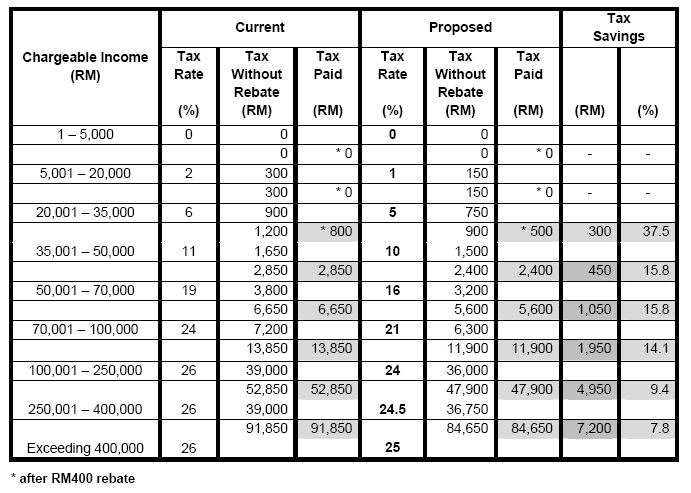

This will be in effect from 2020. One of the key proposals in this years Budget is the increase in individual income tax rate highest band from 28 percent to 30 percent for resident individuals with chargeable. A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with a designated.

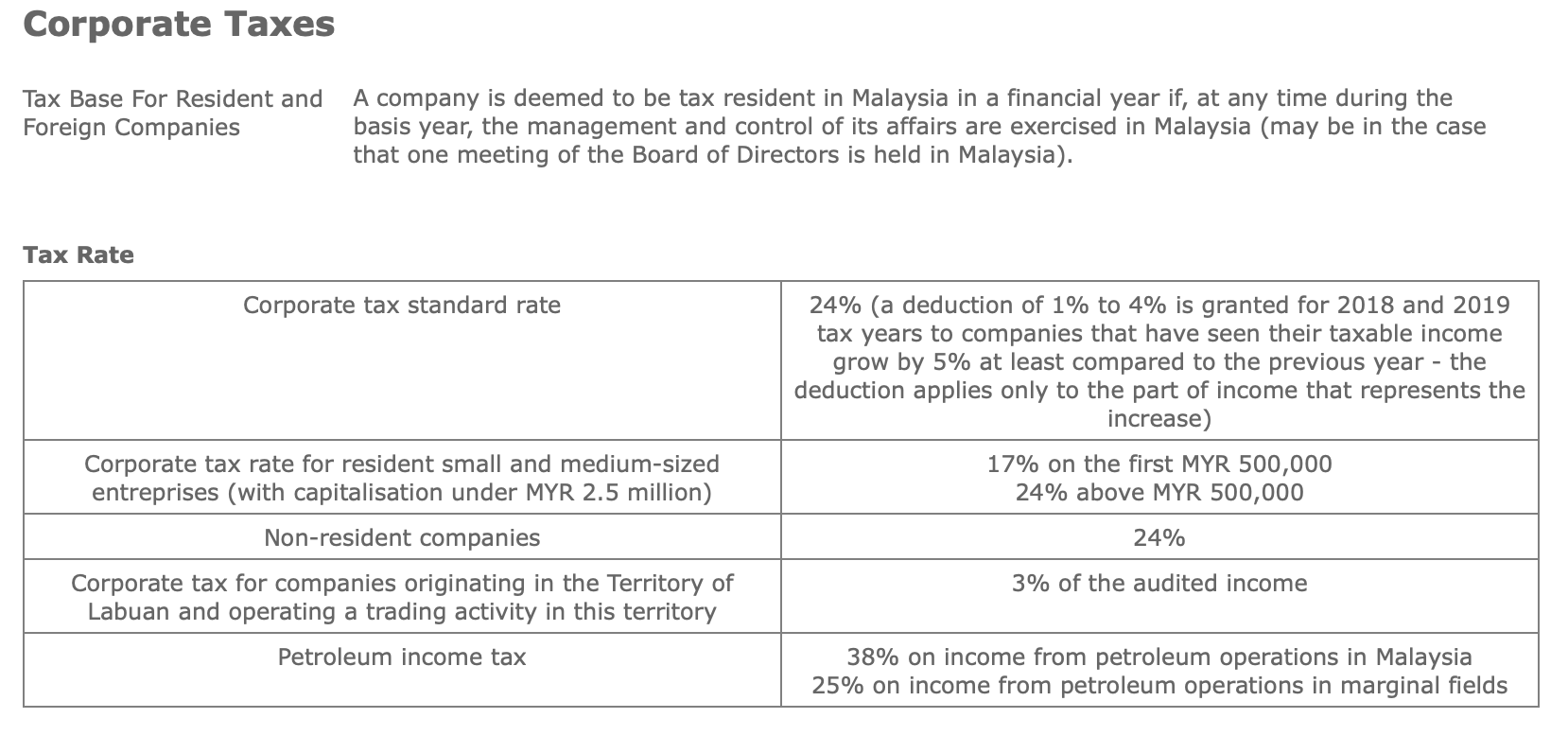

On first RM600000 chargeable income 17 On subsequent chargeable income 24 Resident company with paid-up capital above RM25 million at the beginning of the basis period 24. Effective from 1 January 2020 individuals who are not Malaysian citizens are subject to RPGT at a rate of 30 for a holding period up to five years and 10 for a holding period exceeding five. A specific Sales Tax rate eg.

Increase to 10 from 5 for companies Increase to 5. It should be noted that this takes into account all your income and not only your. The standard Medicare tax is 145 percent or 29 percent if youre self-employed.

With the Budget 2019 the RPGT for disposal of real estate from the 6th year of ownership onwards will be increased. If taxable you are required to fill in M Form. Tax Booklet Income Tax.

However non-residing individuals have to pay tax at a flat rate of 30. Petroleum income tax Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in Malaysia. There are exemptions from Sales Tax for certain persons eg.

Everyone who earns income pays some of that income back into Medicare. An effective petroleum income tax rate of 25. A qualified person defined who is a knowledge worker residing in.

Why It Matters In Paying Taxes Doing Business World Bank Group

Clarke County Reservoir Project Engineering Reports Return With Added Costs Osceola Sentinel Tribune

Budget 2014 Personal Tax Reduced In 2015 Tax Updates Budget Business News

Individual Income Taxes Urban Institute

Real Property Gains Tax Rpgt In Malaysia 2022

Malaysia Personal Income Tax Guide 2020 Ya 2019

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

Progressive Tax Definition Taxedu Tax Foundation

Effective Tax Rate Formula Calculator Excel Template

List Of Countries By Tax Rates Wikipedia

The State Of The Nation Finding Room To Lighten The Middle Income Tax Burden The Edge Markets

Italy Government Debt To Gdp 2019 2022 Statista

Ecuador Tax Preparation Time Data Chart Theglobaleconomy Com

10 Things To Know For Filing Income Tax In 2019 Mypf My

Income Tax Formula Excel University

Individual Income Tax In Malaysia For Expatriates

Taxing High Incomes A Comparison Of 41 Countries Tax Foundation

0 Response to "income tax rate 2019 malaysia"

Post a Comment